The pace of the global economic recovery from the Covid-19 pandemic appears uneven.

Recent US economic data has been at the optimistic end of expectations. However, activity in the UK, where Brexit looms large again, has lagged forecasts.

The risks of a second Covid-19 wave (and, potentially, more severe lockdowns) are growing.

But so too is the probability of upside scenarios materialising. International trade has shown signs of picking up. This would particularly benefit China.

Given the widening risks, market volatility could pick up in the coming months. This makes it even more important to ensure you have a strategic, long-term investment plan in place.

How have our portfolios done?

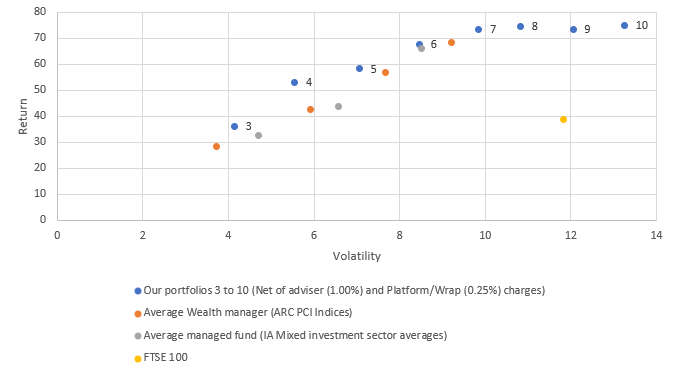

Our portfolios focus far more on the longer-term view than the shorter term. They do not ignore it, but we focus far more on managing risk than we do reaching for returns. Our portfolios are now more than eight years old and have been getting to the point where they have gone through a full market cycle. As you can see below, they have outperformed the average wealth manager and managed fund over the last eight years:

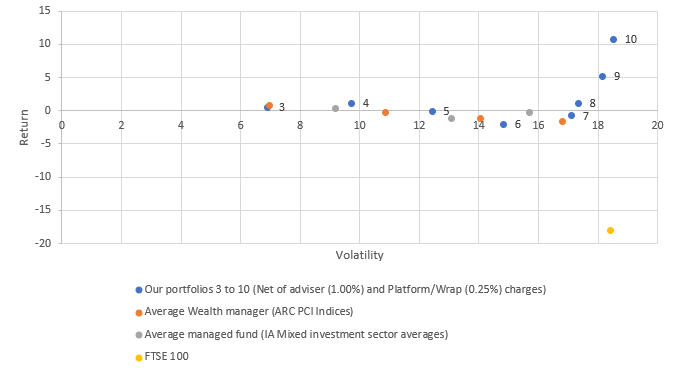

Over the last year this has also broadly been the case:

All data taken from Financial Express.

You should be aware we will not always outperform. We stick to a set level of risk and refrain from trying to time the markets. Over the short term, this may lead to underperformance. Over the long term, our investment process should help our clients get suitable returns.

For more information about our portfolios, you can find the factsheets here and a summary of how we put them together here.

Be aware that past performance is not an indicator of future returns and markets can go down as well as up.

Do you need some help with deciding how best to invest? Feel free to book in a free no-obligation chat here.