Equity markets have had a much quieter first three months in 2021 than they did last year.

The FTSE 100 appears to remain a laggard, but that ignores the recent strength of sterling. Similarly, the standout 10.3% rise of the Euro Stoxx 50 drops to 2.1% when we factor in the decline in the Euro.

There has been a trend towards value over the quarter. This is evidenced in the USA where the more heavily tech-weighted S&P 500 underperformed the Dow Jones Industrial Index by 2%. Emerging markets were relatively disappointing in Q1, dragged down by China and rising US bond yields.

Increasing bond yields were a notable feature of the quarter. Although base rates and 2-year Government bond yields did not change much, 10-year yields rose sharply. There is now talk of 10-year US Treasuries breaching the 2% barrier before the end of the year. This is more than double the starting level. The rises in yields have caused the value of fixed-interest based investments to fall. In turn, this has provoked talk of a fundamental review of the place of bonds in a portfolio.

We believe this is misconceived. The primary role of fixed interest in an investment portfolio is not to drive returns. Instead, it is to act as a stabiliser. In the main, bond prices also move in the opposite direction to share prices, especially during periods of market turmoil. This is why we argue that the case for a balanced portfolio of stocks and bonds, remains intact. Whether yields are negative or positive, bond prices tend to rise when equities fall, and this diversification benefit tends to come at the expense of foregone return.

Total returns from bonds, though lower than in the past, would also be likely to remain positive over the long term as cash flows from rising yields were reinvested. We would be wary of any solution promising higher returns than bonds with similar defensive attributes. These usually come with alternative risks such as additional liquidity risk.

How have your portfolios done?

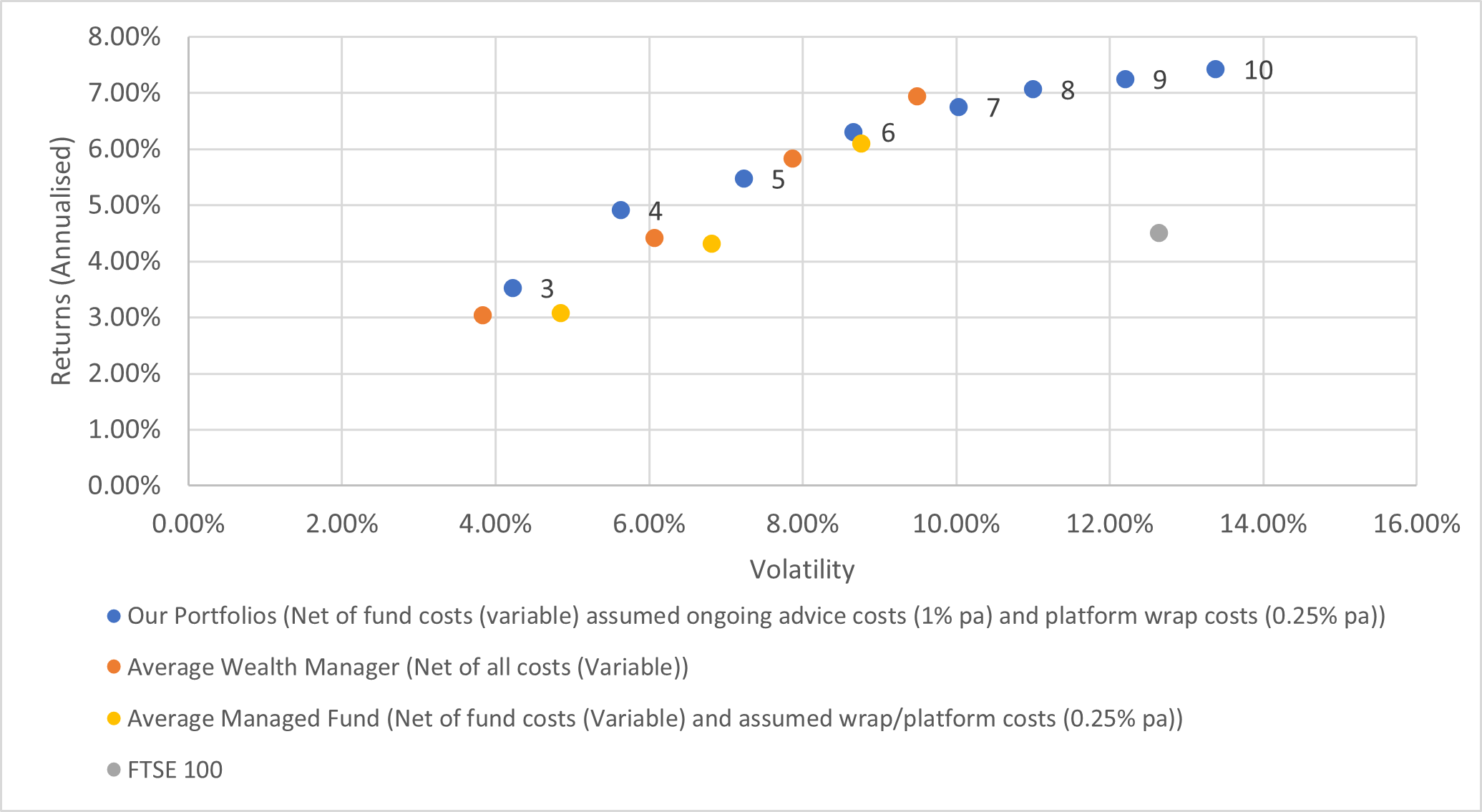

Our portfolios focus far more on the longer-term view than the shorter term. They do not ignore it, but we focus far more on managing risk than we do reaching for returns. Our portfolios are now more than eight years old and have been getting to the point where they have gone through a full market cycle. As you can see below, they have broadly outperformed the average wealth manager and managed fund over the last eight years:

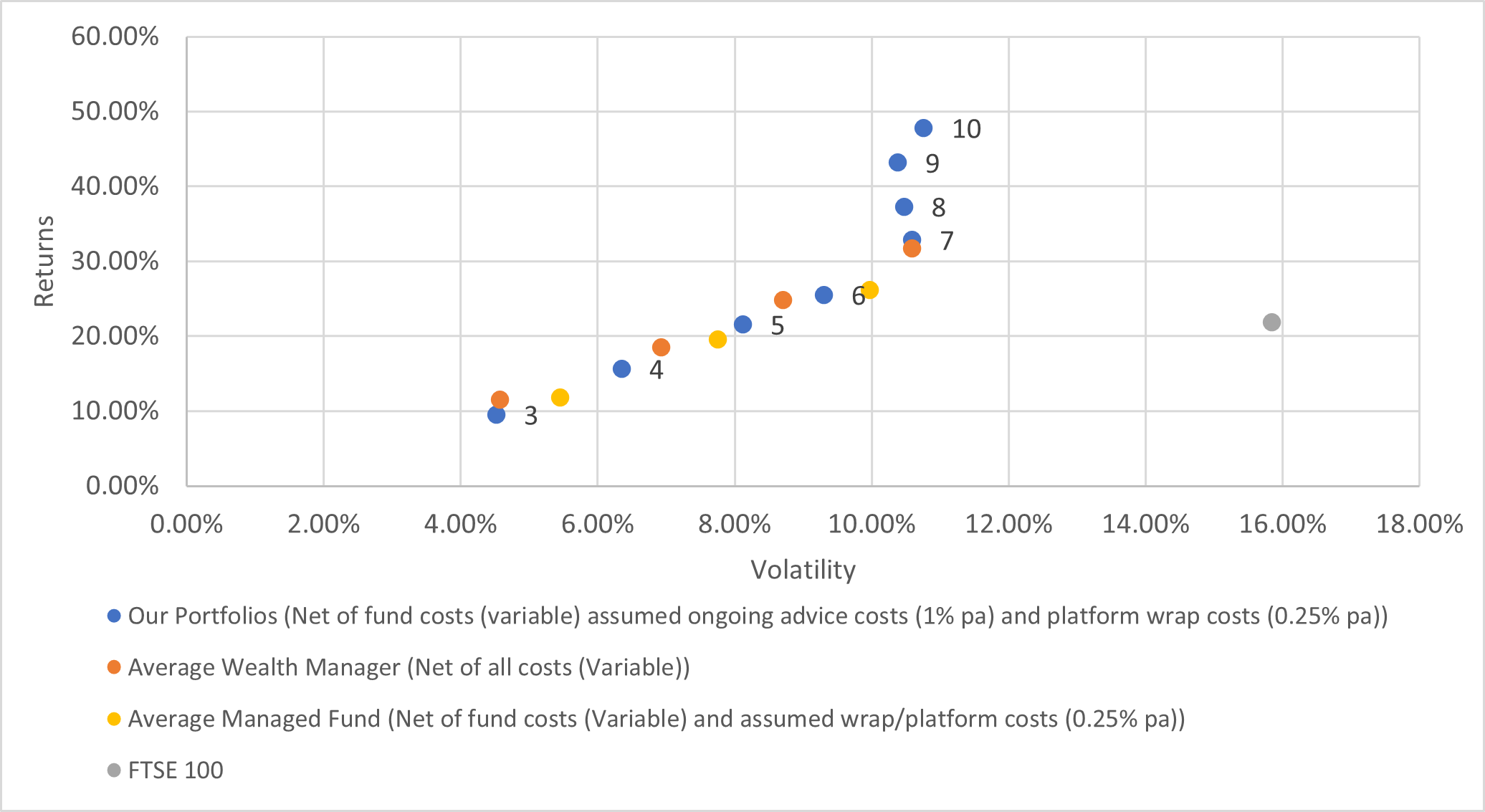

Over the last year this has also broadly been the case:

All data taken from Financial Express.

You should be aware we will not always outperform. We stick to a set level of risk and refrain from trying to time the markets. Over the short term, this may lead to underperformance. Over the long term, our investment process should help our clients get suitable returns.

For more information about our portfolios, you can find the factsheets here and a summary of how we put them together here.

Be aware that past performance is not an indicator of future returns. Markets can go down as well as up.