Watching your portfolio’s returns go up and down can be an emotionally trying experience. Rebalancing to a predetermined, diversified asset mix makes it so you do not have to worry about market instability as much.

Having a suitable mix of assets in your portfolio can serve as a buffer against extreme swings in the market. As a result, you can feel more confident about your portfolio’s ability to potentially preserve value in turbulent markets.

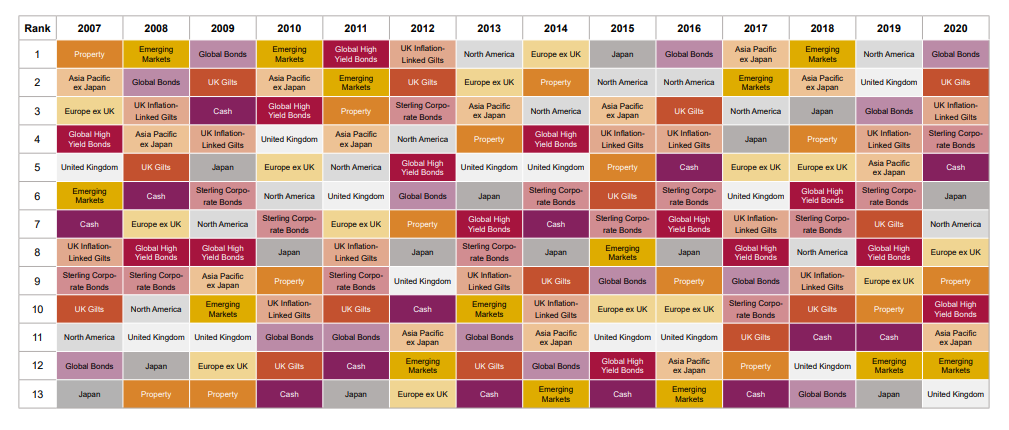

A portfolio will contain a mix of different asset classes such as UK Equities, Global bonds etc. In any year, certain asset classes will do better than other ones. This will result in this portfolio having a higher weighting to those asset classes which have done well. Conversely, it will have a lower weighting to those that have not done so well. However, just because a certain area of the market has done well one year this does not mean it will do so the next. The chart below illustrates the point.

Making sure you are not overexposed to assets ensures you do not have too much in the one which could underperform the next year. This is what rebalancing does. It resets the portfolio where all the allocations revert to what they should be.

Taking the emotion out of investing

Rebalancing enforces a buy low sell high philosophy on the portfolio. This is where those assets which have done well are sold to buy those which have not done well. This may seem counter-intuitive. However, those assets that have done well might be worth more than they really should be and those that have done not so well might be worth less than they should be. In the short term, there is the risk that buying more assets which are experiencing volatility may increase the risk of your portfolio from what it was.

Managing risk

Many investors feel it is worth it to accept lower returns in return for reduced exposure to risk and instability, which helps them sleep better at night. As the markets move, however, the blend of assets within your portfolio can also change or “drift”. I will use an example of two hypothetical portfolios, each consisting of 50% equities and 50% bonds. One of them you rebalanced regularly. The other allowed to “drift,” by not rebalancing. Over 30 years, the rebalanced portfolio would have less volatility (ups and downs in its value).[1]

For people close to their financial goals or who just do not like risk, this can be meaningful.

Do you need some help with deciding how best to achieve investment success? Feel free to book in a free no-obligation chat here or get in touch.

[1] Yan Zilbering, Colleen M. Jaconetti, and Francis M. Kinniry Jr., 2015. Best practices for portfolio rebalancing. Valley Forge, Pa.: The Vanguard Group.