As the world grapples with a global pandemic, we face a tough time.

There are lots of opinions on Covid-19, some more informed than others. Our role is not to add to these but to advise them on how they have impacted on their financial planning.

Stock markets across the world have fallen, recovered briefly, and then fallen again. At the time of writing, the FTSE World Index, a collection of 3,000 of the world’s largest companies has fallen by 20%.

After over a decade of growth, the global stock markets are officially in bear territory.

Being prepared for this

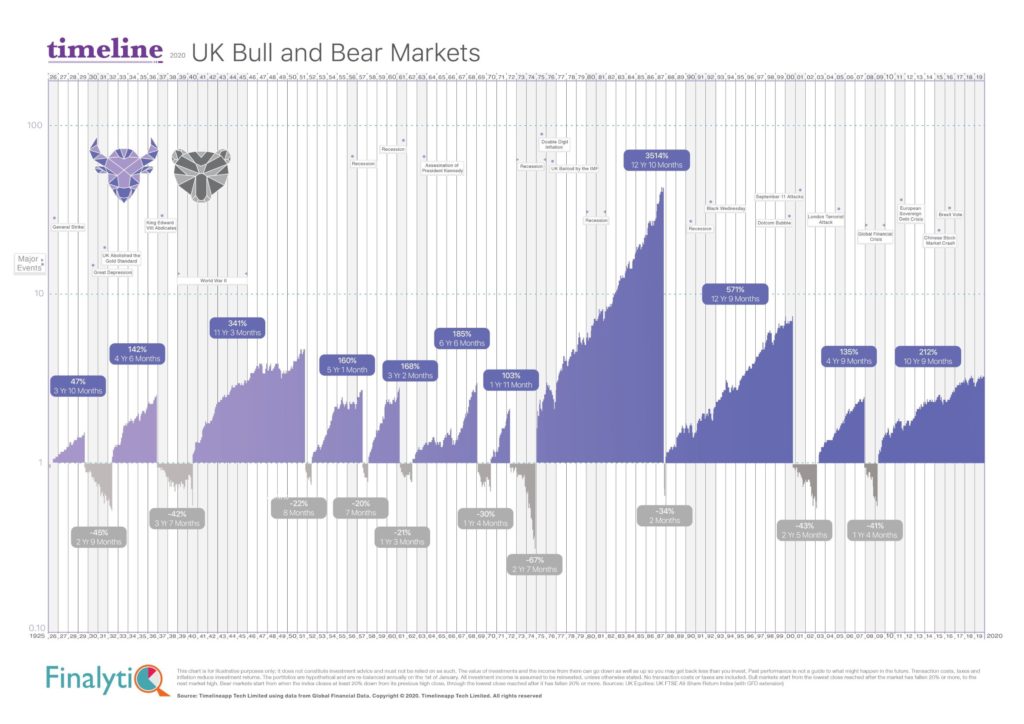

The reality is this type of decline in the markets is a part of investing. No one could predict the exact trigger for the most recent decline. Yet over the past few years, we have prepared ourselves and our clients for this. It may feel different but this latest decline, so far, is well within the range of historical scenarios. The picture below from https://www.timelineapp.co/ shows just how robust the stock markets of the world are.

The worst fall the UK stock market has seen since 1900 was the great recession of 1972/3. Stocks fell 67% over two and a half years. What followed was 13 years of growth and returns of 3,514%!

There have been 16 bear markets (a drop of more than 20%) since 1900 and 103 bull markets (an increase of more than 20%). On average a bear market (falling market) lasts 1.3 years and a bull market (rising market) lasts 7.9 years.

We have written about the need to stress-test your financial plans. We knew a market decline would happen at some point but we could not predict what would start it and when. Nobody could.

How bad could this get?

Early signs suggest the current bull market has been faster than the previous ones. There is some evidence to show a market will recover as fast as it has fallen

One thing bear markets have in common though, is they come to an end.

Diversification proving its value

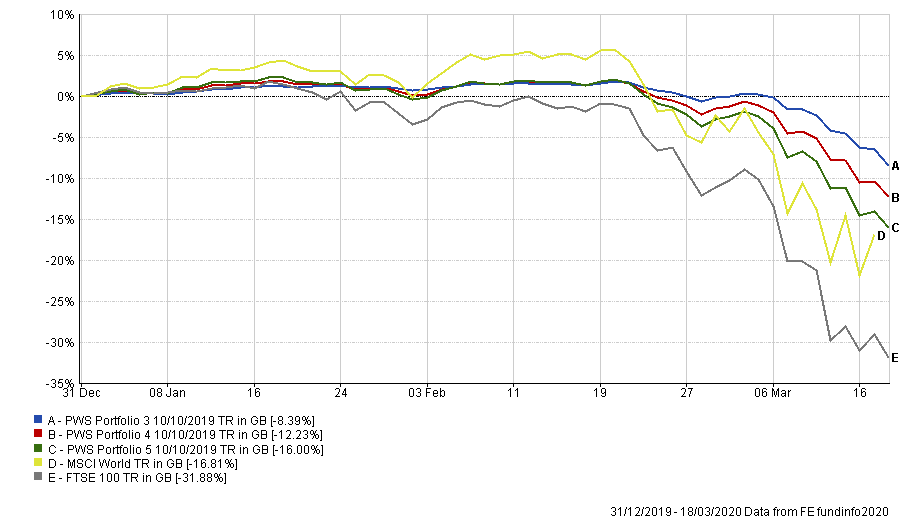

We build well-diversified portfolios to reduce the exposure to market downturns like this. The graph below shows our portfolios have fallen less than world equities and the FTSE 100.

So, the next time you watch the news remember you are not just invested in the FTSE 100. You invest in different markets and assets across the world.

What to do now

Firstly, you should decide whether you need to make any changes to your financial plan. If not then there is no need to change your investment strategy. Jumping off a ship in turbulent waters will only cause more harm than good.

Where clients are taking income, we have advised them to change how they fund them. This should reduce the impact of the market falls.

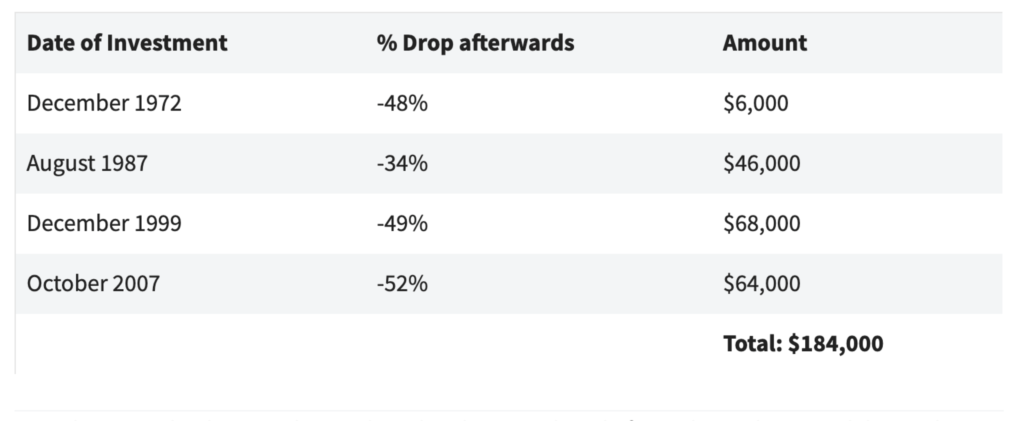

To finish I want to share one further article with you for now. This is from Foxy Monkey and you can read the full article here.

It talks about Bob. Bob is an investor who has the worst luck ever. He only invests before every US stock market crash. He starts in 1972.

In 2013 Rob retires. Guess how much he has made on his investments?

$1,100,000

So, the advice is very much to hang tight. I have invested my own money in the same way as our clients and I have felt the pain of seeing the value fall. The government has said it will do whatever it takes we will get through this.